The boards of directors of Zenith Bank Plc, Guaranty Trust Bank (GTBank) Plc and Access Bank Plc and have scheduled meetings later this month to consider and approve the audited financial statement and accounts of the banks for the year ended December 31, 2019. The meetings will among others consider final dividend recommendation to be made to shareholders.

The notification of the scheduled board meetings quickened investors’ appetite for three of Nigeria’s five largest banks. GTBank, Nigeria’s largest financial services company, in terms of market capitalisation, rose by 90 kobo at the weekend to close at N30.10. Zenith Bank, the second largest bank, also rose by 55 kobo to close at N19.25 while Access Bank appreciated by 5.0 kobo to close at N10.15 per share.

In separate regulatory filing, the three banks indicated that their directors would be meeting to review and approve the earnings report and accounts for the 2019 business year, preparatory to sending the accounts for the clearance of the Central Bank of Nigeria (CBN) before release to the investing public at the Nigerian Stock Exchange (NSE).

GTB’s board is scheduled to meet on Wednesday, January 22, 2019 while the boards of Zenith Bank and Access Bank will meet on Tuesday, January 28 and Wednesday, January 29, 2019.

Extant listing rules at the Nigerian Stock Exchange (NSE) require quoted companies to submit their annual audited account to the Exchange not later than 90 calendar days after the relevant year-end, and published same in at least two national daily newspapers not later than 21 calendar days before the date of the annual general meeting. They are also required to post same on their websites with the web address disclosed in the newspaper publications. Also, an electronic copy of the publication shall be filed with the NSE on the same day as the publication.

Most quoted companies including all banks, major manufacturers, insurers, oil and gas companies, breweries and cement companies use the 12-month Gregorian calendar year as their business year. The deadline for the submission of the annual report for the year ended December 31, 2019 is thus Monday March 30, 2020. The NSE meanwhile gives special recognition to companies that submit their reports earlier than others.

Most analysts at the weekend said the scheduled meetings by the three leading banks marked the onset of the earnings season citing increased demand for the shares of the banks.

The three banks, which had paid interim dividends based on their first-half results, are expected to determine their final dividends at the board meeting later this month. The first-half results, which were audited, were regarded as more indicative of the potential of the banks for the 2019 business year. GTB, which had paid interim dividend of 30 kobo per share, is widely expected to pay a final dividend not less than N2.45 per share paid for the 2018 business year. GTB’s earnings per share had stood at N3.50 for the six-month period.

Zenith Bank had also paid an interim dividend of 30 kobo for earnings per share of N2.83 for first half 2019. Access Bank had distributed an interim dividend of 25 kobo as net profit after tax rose from N39.6 billion in first half 2018 to N63.01 billion in first half 2019.

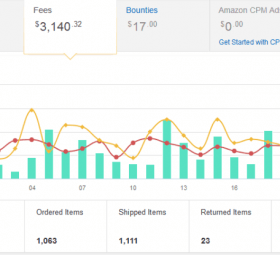

The Nation had reported that Nigeria’s five topmost banks recorded a total profit of N416.55 in the first half of 2019 as the largest commercial lenders continued to draw on technologies and improved operating efficiency to mitigate headwinds and improve underlying profitability of their businesses.

Average profitability in the top five banking groups improved by a percentage point, which translated into a 12.1 per cent increase in total pre-tax profits recorded by the top five banks. The average pre-tax profit margin for the top five groups inched up from 33.35 per cent in first half 2018 to 34.14 per cent in the first half of 2019, undercut by a decline in profitability of the third largest bank.

The top five banks, which traditionally pay cash dividend twice a year, distributed N44.22 billion as interim cash dividend for the first half of this year, with interim dividend per share ranging from 20 kobo to N1.

The top five banks, by market capitalisation, otherwise known as the first tier banks, including Guaranty Trust Bank (GTB) Plc, Zenith Bank International Plc, Stanbic IBTC Holdings Plc, Access Bank Plc and United Bank for Africa (UBA) Plc.

A market intelligence report by The Nation showed all top-five banks witnessed steady growths across key performance indicators with the exception of Stanbic IBTC, which suffered a decline in profitability. The top-five banks’ gross earnings rose by 9.79 per cent from N1.17 trillion in first half 2018 to N1.29 trillion in the first half of 2019. Total pre-tax profit by the biggest five commercial lenders grew by 12.08 per cent to N416.55 billion in first half 2019 compared with N371.66 billion in the comparable period of 2018. Total net profit, after taxes, increased by 13.22 per cent from N303.8 billion to N343.96 billion.

Average gross earnings within the top-five group had increased from N234.79 billion in first half 2018 to N257.77 billion in the first half of 2019. Average profit before tax also improved from N74.33 billion to N83.31 billion. After taxes, the average net profit increased from N60.76 billion to N68.79 billion.

.jpeg)